Are you considering investing in the financial market of India? You may ask if local stock exchange is the best decision. The metro and the stock exchange, also known as MSEI (Metropolitan Stock Exchange), is one of the largest in the country. Understanding that can help you make smarter investment decisions.

To decide if MSEI is right for you, look at its history, main features, and rules. The metropolitan stock exchange lets companies list their shares and investors trade. Learning about it can open up new investment possibilities for you.

Key Takeaways

- The metropolitan stock exchange has the metropolitan stock exchange essential knowledge you need to take to make investments.

- The Indian financial market has a major role of the metropolitan stock exchange.

- Companies can list their shares on MSEI and investors can trade.

- To determine whether MSEI is a good buy or not, there are several things to be taken into account, with the first part being the exchange’s history and regulations.

- You come up with investment opportunities metropolitan stock exchange

- Support knowledge of the metropolitan stock exchange with great investment decisions.

Understanding the Metropolitan Stock Exchange of India

Thinking about investing in the Metropolitan Stock Exchange of India? It’s key to know its background and how it works. The exchange has a long history, showing India’s financial growth. You might ask who owns MSEI or where is the headquarter of Metropolitan Stock Exchange of India. The exchange is in India, and its ownership is important for its management.

The Metropolitan Stock Exchange of India stands out with its unique features and functions. Some of these include:

- Electronic trading platform

- Real-time market data

- Robust risk management systems

These features help the exchange offer a safe and efficient place to trade.

The exchange follows a strict regulatory framework. This ensures its operations are clear and follow industry rules. The framework aims to protect investors and keep the market fair.

Knowing the Metropolitan Stock Exchange of India’s history, key features, and rules helps you make smart investment choices. Whether you’re experienced or new, understanding the exchange’s operations and management is crucial.

The Business Model and Operations of Msei

If you peer into the metropolitan stock exchange you might wonder, “What is it for?” The place where people buy and sell securities. It earns revenue through transaction fees, listing fees and other services. To begin with the exchange plans to make it attractive for the investors and the companies and to remain competitive in the financial system of India..

The metropolitan stock exchange offers many services. It handles trading, clearing, and settling securities. It also lists and delists companies. Its strong point is efficient, transparent, and secure trading. This makes it a great choice for investors and companies.

Key parts of the metropolitan stock exchange’s business model include:

- Transaction fees: The exchange takes a fee for every transaction that happens, creating a consistent revenue stream.

- Listing fees: Companies that are listed on the exchange are charged listing fees, which is another source of income for the exchange.

- Additional services: The exchange also provides other services, including data feeds, moving the market, and training programs, which also contribute to revenue.

Understanding the metropolitan stock exchange’s business helps you see its importance in India’s finance. It’s designed to benefit everyone involved, keeping it competitive in the market.

Trading Mechanisms and Products on MSEI

At MSEI, you can trade a variety of products. This includes equity, derivatives, and debt instruments. It offers many investment options.

The trading process is designed to be efficient and fair. You can trade in different segments like:

- Equity shares

- Derivatives, such as futures and options

- Debt instruments, including bonds and debentures

Knowing what is traded in msei is key for smart investing. MSEI has a strong trading platform. It offers real-time data, online trading, and a secure settlement system.

MSEI trading hours are student-friendly and could be perfectly suited to all market participants. You can trade during regular hours or in pre- and post-market sessions. The system of confirming is rapid and safe.

| Trading Segment | Trading Hours | Settlement Procedure |

|---|---|---|

| Equity | 9:15 am – 3:30 pm | T+2 days |

| Derivatives | 9:15 am – 3:30 pm | T+1 day |

| Debt | 9:15 am – 3:30 pm | T+2 days |

Understanding MSEI’s trading mechanisms and products helps you invest wisely. It lets you move through the market with confidence.

Companies Listed on Metropolitan Stock Exchange

When considering investment options, a primary requirement is to know the companies present on the Metropolitan Stock Exchange. This exchange includes a diverse range of companies, from mom-and-pop shops to multinational corporations. For listing the companies need to meet a certain criteria including minimum market value and financial stability.

The rules for listing on the Metropolitan Stock Exchange are strict. They ensure only solid companies make it to the list. This gives investors confidence in their choices. Currently, you can find companies from tech, healthcare, and finance sectors on the exchange.

Listing Requirements

To list on the Metropolitan Stock Exchange, a company must have a market value of ₹25 crores. They also need to meet financial and governance standards. A company’s history of making profits and a strong management team are also important.

Current Listed Entities

Here are some companies currently listed on the Metropolitan Stock Exchange:

- Companies such as Infosys and Wipro

- Healthcare providers like Fortis Healthcare and Dr. Reddy’s Laboratories

- ICICI Bank and HDFC Bank are financial services firms

Comparison with Other Exchanges

The Metropolitan Stock Exchange is unique in India, having many such listings. It centres on small and medium-sized businesses. This also allows investors to invest in companies that are not listed on any other exchanges, such as the National Stock Exchange or the Bombay Stock Exchange.

Investment Opportunities and Considerations

Thinking about investing in the Metropolitan Stock Exchange of India (MSEI)? You might ask is msei a good buy? It’s important to look at the good and bad sides of investing in MSEI. The price of unlisted msei share is also a big factor to think about.

When looking at investment options, it’s key to weigh the pros and cons. Here are some important points to keep in mind:

- Availability of securities: MSEI allows the investors to buy and sell securities in a single place, thus providing liquidity in the given market.

- Diversification: With MSEI, you can achieve diversification in your investments, thereby minimizing risk.

- Potential for growth: Certain companies listed on MSEI may have a lot of room for growth, given that India has a burgeoning economy

To make a smart choice, you should also think about the price of unlisted msei share. You need to understand the factors that impact the price — such as demand or the company’s financial position.

So msei a good buy or not? depends on your investment objectives and how much risk you want to take. By weighing the pros and cons, you can determine if investing in the Metropolitan Stock Exchange of India is a good option for you.

| Investment Option | Potential Benefits | Potential Risks |

|---|---|---|

| MSEI-listed companies | Diversification, growth potential | Market volatility, company-specific risks |

| Unlisted MSEI shares | Potential for high returns, limited market liquidity | Higher risk, limited transparency |

Technology Infrastructure and Trading Platform

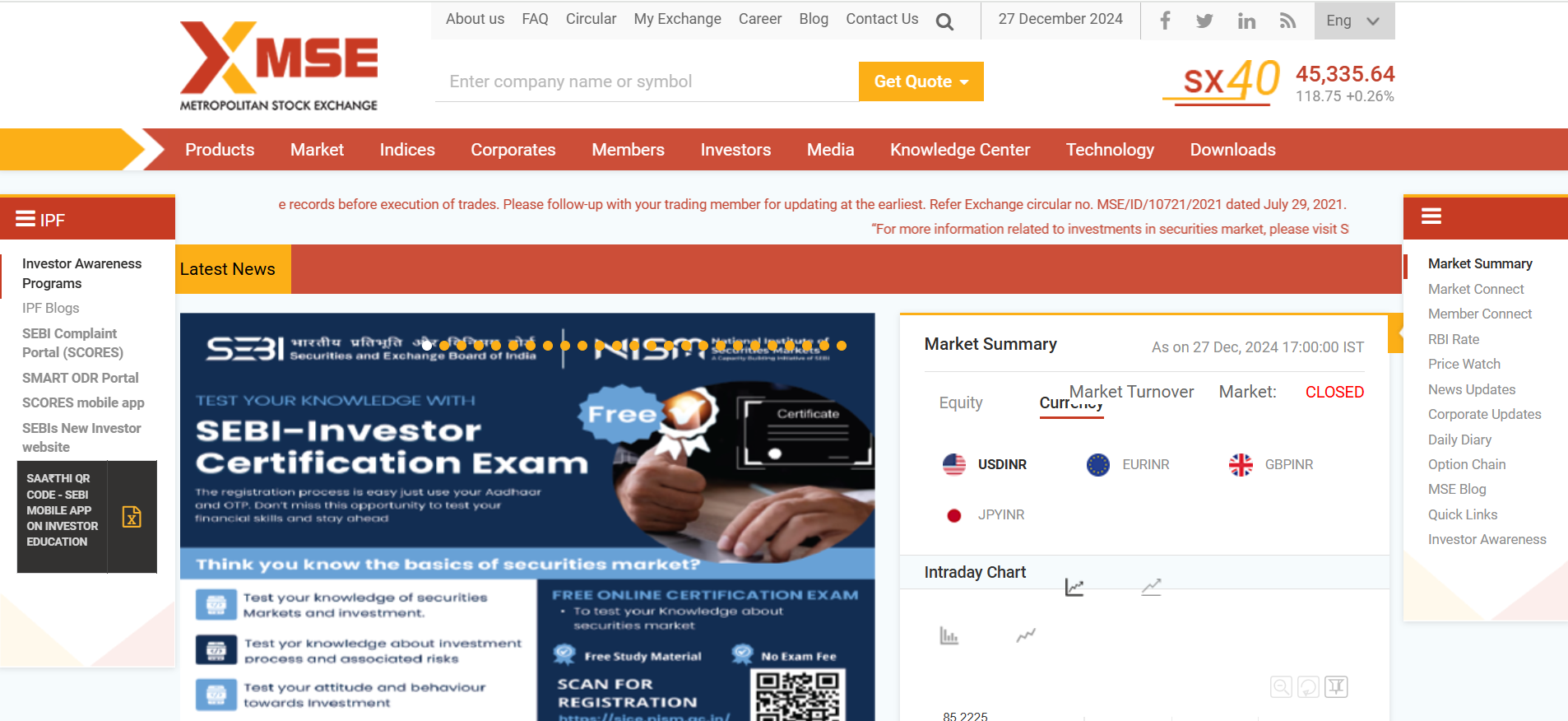

The metropolitan stock exchange has invested a lot in its technology. This makes trading smooth and easy. You can use online trading terminals or mobile apps to access the platform. The digital systems offer real-time data and advanced order management. For more information about msei visit https://www.msei.in/

The exchange also focuses on security. To safeguard the platform, it employs encryption, firewalls, and intrusion detection. This makes it possible for you to trade without fear for your safety.

Digital Trading Systems

The exchange operates various systems capable of processing a large volume of trades. And they’re extremely reliable, with redundant systems to prevent downtime. You can also guarantee that your trading experience is seamless and consistent.

Security Measures

Security is a top priority for the metropolitan stock exchange. It has put in place several measures to protect investors and keep the market safe. These include:

- Encryption to protect data in transit

- Firewalls to prevent unauthorized access

- Intrusion detection systems to identify and prevent potential threats

Access and Connectivity

You can get to the exchange’s platform in several ways. These include:

- Online trading terminals

- Mobile apps

- Direct market access

The metropolitan stock exchange’s technology and platform aim to make trading easy and secure. With its advanced systems, strong security, and many access points, you can trade confidently and without hassle.

Conclusion: Making Informed Decisions on MSEI

The Metropolitan Stock Exchange of India (MSEI) offers unique investment chances and a safe trading space. It’s key to deeply research the listed companies and grasp the trading ways. Also, keep up with the exchange’s tech and security steps.

Investing wisely means always checking the market, getting expert advice, and spreading your investments. The MSEI can boost your investment plan, but weigh the risks and gains well before investing. For technical analysis information visit https://nifty50trends.com/technical-analysis/

With the knowledge from this article, you can better decide if MSEI fits into your investment strategy. Stay alert, stay updated, and seize the chances the metropolitan stock exchange presents.

FAQ

Is MSEI a good buy?

Whether MSEI is right for you depends on your investment goals and risk tolerance. The Metropolitan Stock Exchange offers unique opportunities. It’s crucial to research the exchange and its companies before investing. A financial advisor can help you decide if MSEI fits your strategy.

What is the price of unlisted MSEI shares?

The value of unlisted MSEI shares is determined by the company’s financial situation and market demand. Because they aren’t traded publicly, prices are determined through private transactions. Unlisted shares investment is not without risk. Do your due diligence on the company and consult experts before buying.

Which companies are listed on the Metropolitan Stock Exchange?

MSEI lists companies from various sectors like technology and healthcare. Some notable companies include [insert examples]. You can find a full list on the MSEI website.

Who owns the Metropolitan Stock Exchange of India?

MSEI is owned by a group of investors, including financial institutions and brokerages. This structure aims to balance interests and ensure transparency. MSEI is based in [insert city], India, overseeing trading and compliance.

What is traded on the Metropolitan Stock Exchange?

MSEI trades a variety of products, including equity securities and derivatives. It also offers debt instruments and currency pairs. This platform helps investors buy and sell, promoting market liquidity.

What is the business of the Metropolitan Stock Exchange?

MSEI operates a regulated financial market. Its main goals are to provide a trading platform and ensure fair prices. It also aims to protect investors and offer diverse products and services. MSEI generates revenue through various fees and services.

Where is the headquarters of the Metropolitan Stock Exchange of India?

MSEI’s headquarters is in [insert city], India. It oversees operations, compliance, and strategy. Being in [insert city] helps MSEI connect with the financial hub and collaborate with others.