Recently In the Indian share market, Unimech Aerospace & Manufacturing Limited, Blue-chip Company Leading Players in Aerospace, Defense, Energy, and Semiconductor field, be dragged with its IPO. This blog discusses the company’s IPO details, listing performance, financials, and prospects as well as a detailed share price trajectory and market outlook.

Overview of Unimech Aerospace Share Price

Established in 2016, Unimech Aerospace is a recognized leader in engineering solutions for close-tolerance components. The aerospace and defense sector is the company’s list of primary industries served. Unimech Product Range Unimech has a diverse product portfolio that includes:

- Aero Tooling Advanced tooling systems designed for the aerospace sector

- Aviation Tools: Tools specialized for aviation and aerospace operations

- Electromechanical sub-assemblies: Devices requiring low tolerances for sensitive use

- Precision parts: high quality parts way across sectors

Unimech has become a trusted partner in the aerospace sector, serving international airframe and aero-engine original equipment manufacturers (OEMs) and their approved licensees. We’re recognized to have two modern manufacturing plants with internationally accredited certifications:

- AS 9100D: Aerospace Quality Management System

- BS EN ISO 9001:2015: Quality management 3.

- ISO 45001:2018: We will discuss occupational health and safety standards

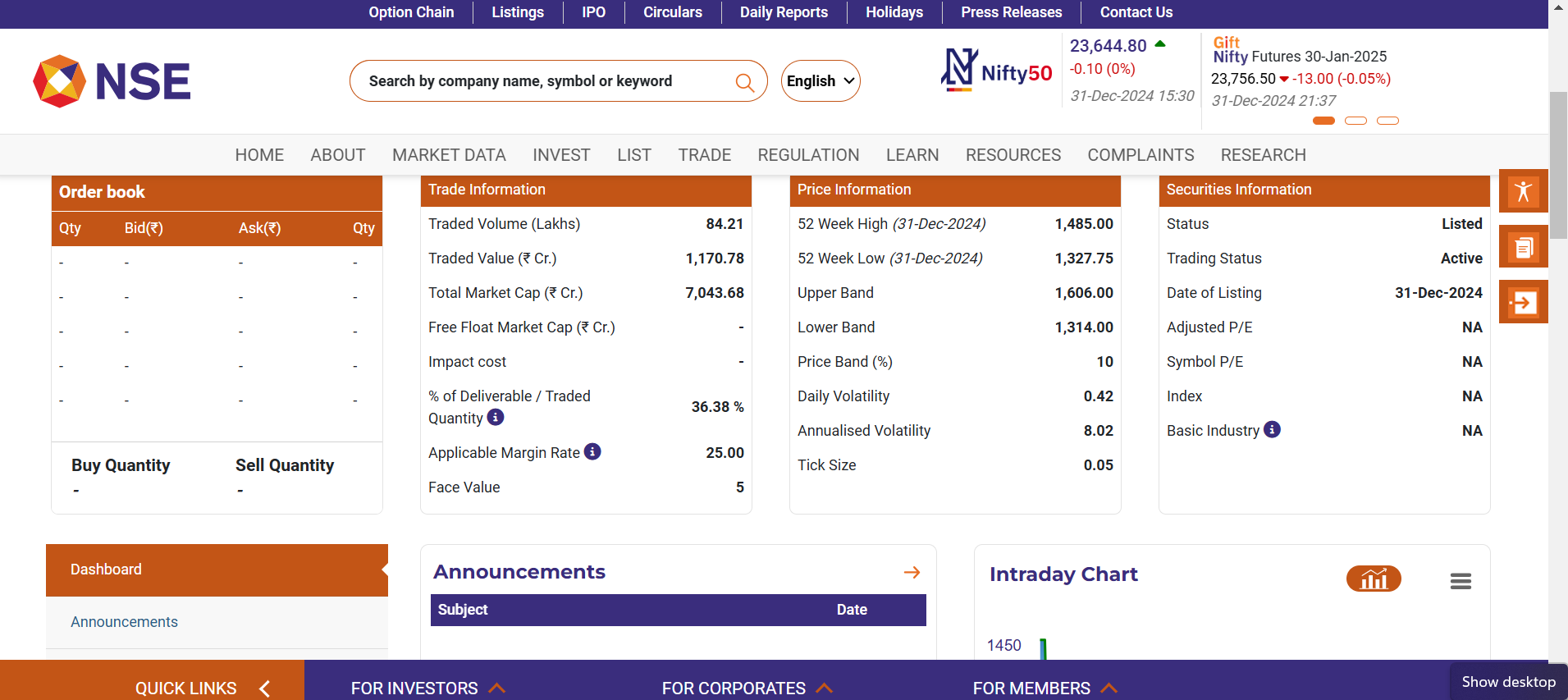

This demonstrates Unimech’s commitment to upholding high standards in quality, safety and operational excellence. For Unimech share price details visit https://www.nseindia.com/get-quotes/equity?symbol=UNIMECH

Details of Unimech Aerospace IPO

The IPO of Unimech Aerospace opened for subscription between December 23 and December 26, 2024, at a price band of ₹745 to ₹785 per equity share. The IPO Size was ₹500 crore, and it consisted of:

- New Issue: 32 lakh equity shares worth ₹250 crores

- Offer for Sale (OFS): Equally, the number of shares held by existing shareholders

Subscription Highlights

The IPO was oversubscribed by 175.31 times. Such strong demand was seen across all categories of investor::

- Qualified Institutional Buyers (QIB): 317.63 times subscription.

- Non-Institutional Investors (NII): 263.78 times subscription.

- Retail Individual Investors (RII): 56.74 times subscription.

- Employee Portion: 97.81 times subscription.

This indicates strong interest from investors, reflecting the confidence in Unimech’s growth potential and its strategic positioning in the aerospace and defense sectors.

Unimech Aerospace Listing Performance

The stock exchanges couldn’t get enough of Unimech Aerospace on December 31, 2024 as it made a stellar debut Here are the listing details:

- BSE: The stock opened at ₹1,491, about 90% higher than the IPO upper price band of ₹785.

- NSE: Shares listed at ₹1,460, an 86% premium.

Post-Listing Volatility

Despite the strong debut, the Unimech’s stock were volatile after it was listed. The stock price fell as much as 9.4% to end at ₹1,350.4 at the BSE after hitting an intraday high. The stock also hit its 10% lower circuit at ₹1,341.95 suggesting profit booking by early investors.

Financial Performance of Unimech Aerospace

Unimech’s financials have been a big market draw. For the fiscal year preceding the IPO, the company had reported:

- Revenue: ₹208.8 crore.

- Profit After Tax (PAT): ₹58.1 crore.

- Market Capitalization (Post-IPO): ₹3,992.3 crore.

- Price-to-Earnings (P/E) Ratio: 68.7x.

The figures highlight Unimech’s strong financial condition and a promising outlook for continuous expansion. The significant P/E ratio indicates high expectations among investors, corresponding to the company’s direction to focus on high-growth industries.

Sectoral Growth and Market Opportunities

Aerospace and Defense Sector in India

The Indian aerospace and defense sectors are expected to grow exponentially due to various factors, including:

- Rising Governmental Expenditure: The government of India has been steadily increasing its investments aimed at defense and aerospace projects to enhance the country’s self-sufficient manufacturing capabilities.

- Make in India Initiative: Under this flagship initiative of the government, the aerospace industry has been encouraged to build components and systems in the country.

- Global Demand: The focus on outsourcing aerospace manufacturing to cost-effective regions favors Indian players.

Unimech’s Strategic Position

With so much happening in the aerospace industry, Unimech Aerospace is primed to take advantage of these opportunities with its strength in manufacturing, certifications for quality, and relationships with OEMs around the world. Its expertise in precision engineering and innovation fits right into the requirement of the industry. For more information about technical analysis visit https://nifty50trends.com/technical-analysis/

Share Price Analysis and Investor Insights

Short-Term Performance

This was reflective of strong market sentiment for listing day performance of Unimech. But the later volatility underscores the risks of stocks that have just gone public. The fall in share price post-listing indicates that profit booking was exercised by most of the investors, which is a usual trend in IPOs that attract aberrant interest from market players.

Long-Term Potential

However, from a long-term perspective, Unimech’s fundamentals are still strong. Some factors that could contribute to its growth prospects are:

- Growth in Aerospace Market: Unimech Benefits from Growing Aerospace Sector.

- Multiple Revenue Sources: The company operates in several industries, which lowers its reliance on one particular industry.

- Investing in R&D: Having an eye on R&D via consistent investment makes sure Unimech is always one step ahead of technology.

Risks and Challenges

Potential risks you should consider if investing in Unimech Aerospace:

- Regulatory Developments: The aerospace and defense sectors are highly regulated, so any modifications can affect operations.

- Geopolitical Risks: It is a defense player, so the company is also subject to geopolitical factors.

- Technological Innovation: In a tech-driven industry changing at the speed of light, keeping up with R&D can be burdensome.

Expert Recommendations

Should You Buy, Hold, or Sell?

- Recommendation Buy: For long-term investors, Unimech represents a solid option given its strong fundamentals and growth potential.

- Hold: For those who may have gained shares as early investors during the IPO, they might want to hold and see if they believe in the company’s vision for the long run.

- Sell: Listing gains could entice short-term investors to sell, especially amid the stock’s recent volatility.

Conclusion

Unimech Aerospace’s IPO and listing have firmly established the company as a key player in India’s aerospace and defense sectors. The company strategic focus, robust finances, and market positioning are signs for its bright future. Investors need to be cautious as risks exist not only in the stock market but also the industry.

With the Indian aerospace and defense industries poised for growth, Unimech Aerospace is well-positioned to take advantage of these growth opportunities, creating value for shareholders. Whether you are an experienced investor or a novice, it is worth studying Unimech’s journey to learn the ropes of managing in high-growth industries.

Disclaimer: This blog is for informational purposes only and should not be construed as financial advice. Investors are advised to consult with a certified financial advisor before making any investment decisions.